In 2024, as the use of mobile phones increases, something that is trending is user interface (UI) and user experience (UX). These design trends are at the forefront and will influence how consumers engage with and view the digital products of different organizations, be it e-commerce, banking, or finance. There has never been an essential time to pursue excellence in UI/UX design than now, when these fresh trends of making things digital are knocking on the market’s doors.

Currently, the industries that are majorly falling under the digitization category are the banking and finance sectors. One of the first things that comes to mind when discussing banking is KYC, which is crucial in any industry dealing in finance. With technological advancement, we need to focus on customizing the KYC platform in all financial and banking systems with digital experiences for the immersive worlds of augmented and virtual reality. The key to this is to create an interface that is simple to use and allows users to navigate your brand easily. The only way to improve the user experience of KYC is to use UX/UI. Let us take you through a guide on how UI/UX will help provide your customers with a seamless experience.

What is KYC?

KYC stands for “Know Your Customer,” which is a way to verify the client’s identity. If you are wondering why KYC is important in banking,? Know Your Customer (KYC) regulations are designed to protect banks from being used as pawns in money laundering schemes and help them get to know their customers better before extending any credit. It also enables banks to understand their customers and financial dealings to serve them better and manage their risks cautiously.

Places Where Banks Need KYC

- Welcoming new customers and completing their system registration.

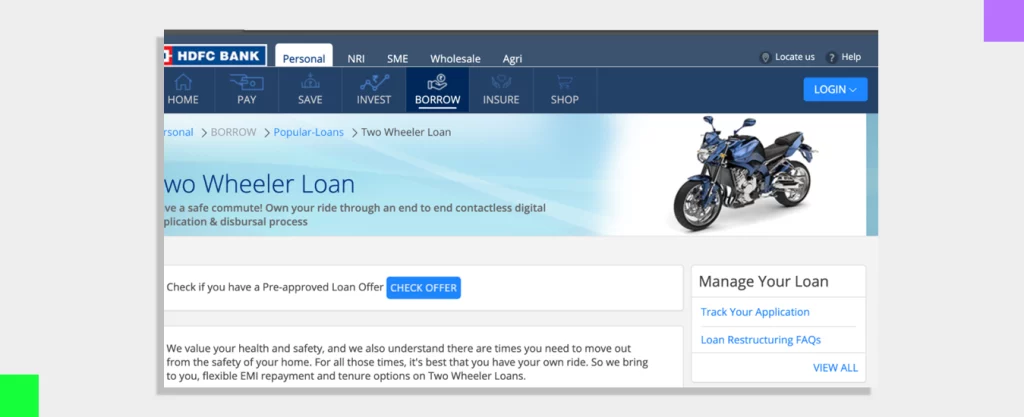

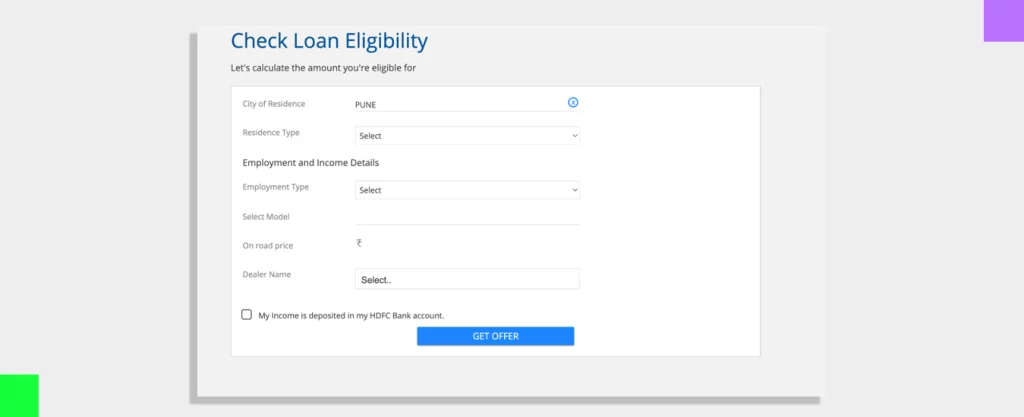

- While checking loan documentation.

- In the course of any transactions.

- Re-confirming with current users.

- Assessing the client’s risks

Now that the banking industry has grown and become more digitalized, e-KYC has replaced manual KYC, which is characterized as an electronic KYC designed to stop money laundering. A lot of banking and financial institutes are adopting e-KYC. According to a report by the Polaris market study, it is anticipated that there will be a 22% increase in the use of digital KYC formats in the future.

What is the Importance of UX/UI in the Banking System?

Since technology is now used for everything, so is the banking system. The need for a great user-friendly design is increasing because it provides ease for the user to navigate through your portal and sustain the website.

How a Strong KYC Form Contributes to a High Rate of Conversion

When it comes to the KYC loan form in particular, there are many benefits to using UI/UX in the

design of the form. Based on the value provided and the user experience, a product’s success is determined.

The factors that determine a product’s success are all taken care of by the UI/UX designers to improve and achieve set goals. UI/UX design is crucial in developing digital products that address a user’s needs directly. It improves sales and product quality. Below are the few components that a designer takes into consideration when designing:

Ease of Use and Clear Information Presentation:

A product’s usefulness and ease of use are key factors in determining its relevance. A product’s UI and UX design greatly influence its ability to solve user problems and, more importantly, provide a hassle-free and enjoyable experience.

Accessibility and Availability:

Undoubtedly, technology has changed how we live and given us access to resources that make life easier. Businesses can benefit from UI and UX design elements, which create roadmaps for product development and make products accessible to users by understanding their unique needs and desires.

Reactiveness and Accuracy:

A product must react quickly to user commands. Therefore, UX design plays a crucial role in giving users easy navigation when interacting with a product. The less time it takes to respond to the commands, the greater the probability that the users will stay on the page.

Customer-Centricity:

It is important to remember that the only things that can persuade a user to accept any product or page feature are its UI and UX design elements. A product’s relevance and positioning in the target market can be rapidly lost in the absence of necessary customer journey map UX design elements that prioritize only the user.

How does the UI/UX Assist Customers in their KYC Journey?

To define the usability and functionality of any digital product, the user interface and user experience are interwoven elements that work together. Because of this, UI and UX design techniques are now essential for successfully implementing and developing any digital product.

Let us guide you a little more on why we need both UI and UX to work together for a better outcome and user experience.

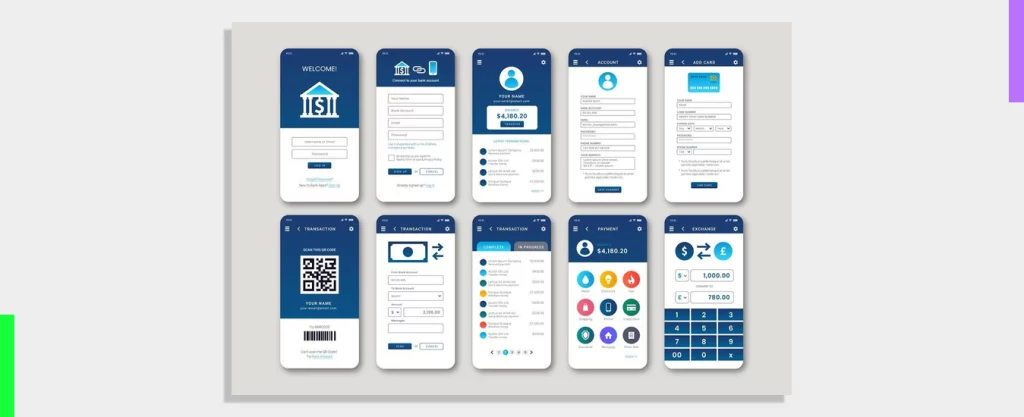

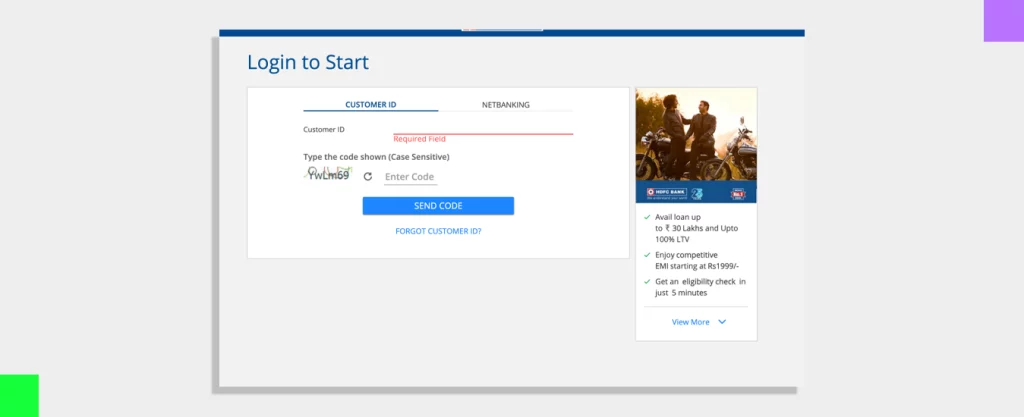

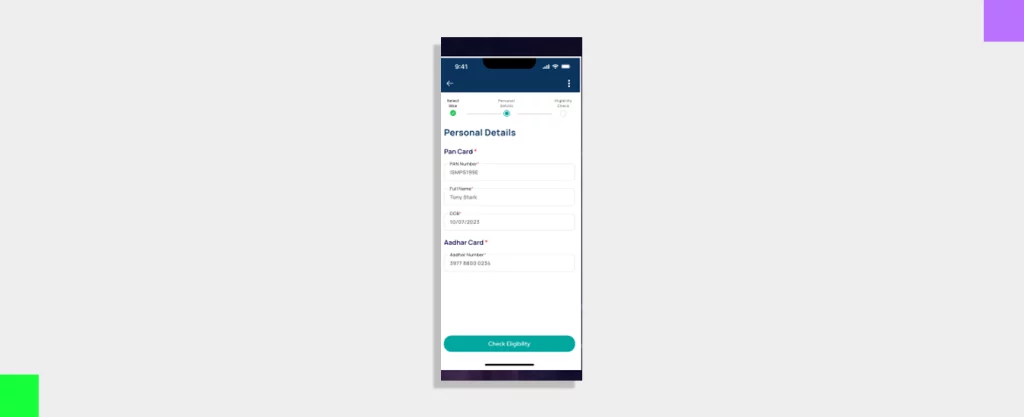

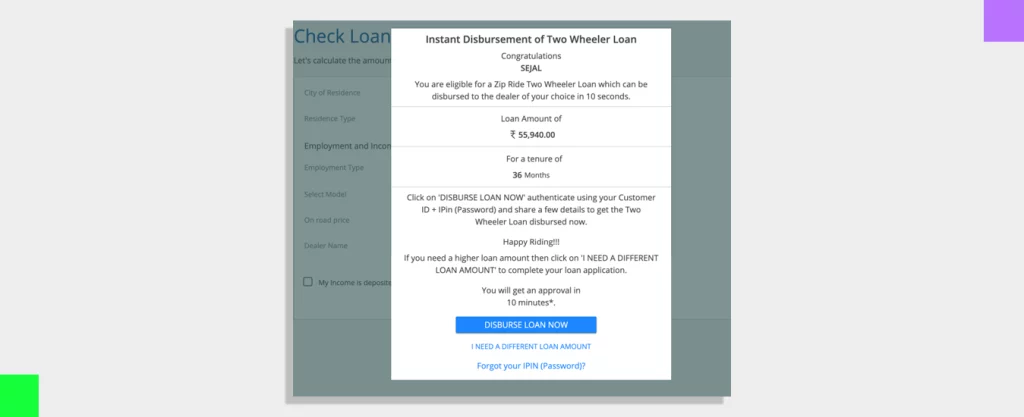

After you make the necessary selection, the 4-step KYC process will start. You can see stylish icons and interactive designs in the app to ease the selections and the four steps are described below.

All these display screens that a UI/UX designer creates are interactive and user-friendly, which makes the selection easy and the loan process fast. Therefore, one concentrates on presentation while the other concentrates on functionality and usability to produce a good page with high engagement, or what you can call a user-friendly page. Every organization should have a page with a UI/UX design.

Why the yellow slice UX design for your KYC?

Selecting the right agency for design validation requires careful consideration. To ease your search, visit yellowslice. in, which contains experts who will help you build a top design model. We are a UI/UX design firm that uses user-centric innovations and research to improve and innovate the user experience.

After understanding your project requirements, Yellow Slice’s research agencies look into the design process and then evaluate teamwork and develop communication. We then consider the scalability and flexibility of the project, handle legal and contractual issues, and gather client testimonials, which helps us develop a top KYC UI design. Choosing us will be an educated choice that will guarantee the success of your UI/UX design project and will coincide with your objectives.

FAQs about UI/UX and KYC Journey:

What is the KYC authentication process?

KYC stands for Know Your Customer, sometimes known as Know Your Client. The KYC, or knowledge and authentication check, is a necessary step in the account opening process that is repeated regularly to confirm the client’s identity. It also enables banks to understand their customers and financial dealings to serve them better and manage their risks cautiously.

Identify the four KYC pillars?

Banks and other financial institutions base their KYC programs on four pillars or elements: risk management, continuous evaluation of the policy and procedures, a customer identification program, and investigation of the clients. When it comes to the KYC form in particular, there are many benefits to using UI/UX in the design of the form. It eases the usage of the system for the user, making it user-friendly, and also takes care of all four pillars when designing.